- Faculty: Bangcaya, Sandra Angela

- Faculty: Vildac, Jay R

- Faculty: Bangcaya, Sandra Angela

- Faculty: POLLESCAS , RICA CAMILLE

- Faculty: Vildac, Jay R

This course deals

with specialized problems likely to be encountered by accountants. The study of

various topics in this course is based upon the recent business developments

and current changes in accounting standards, especially the coverage of

business combination, the preparation of financial statements on the date of

acquisition and subsequent to acquisition. This course includes the general

procedures and specialized problems in home office and branch accounting;

accounting for business combinations and the consolidated statement of

financial position; and accounting for foreign currency transactions and

translation of foreign financial statements

- Faculty: Bangcaya, Sandra Angela

- Faculty: GAZO, Eric

- Faculty: Quiambao, Charisse Angela

- Faculty: Vildac, Jay R

- Faculty: Bangcaya, Sandra Angela

- Faculty: GAZO, Eric

- Faculty: Vildac, Jay R

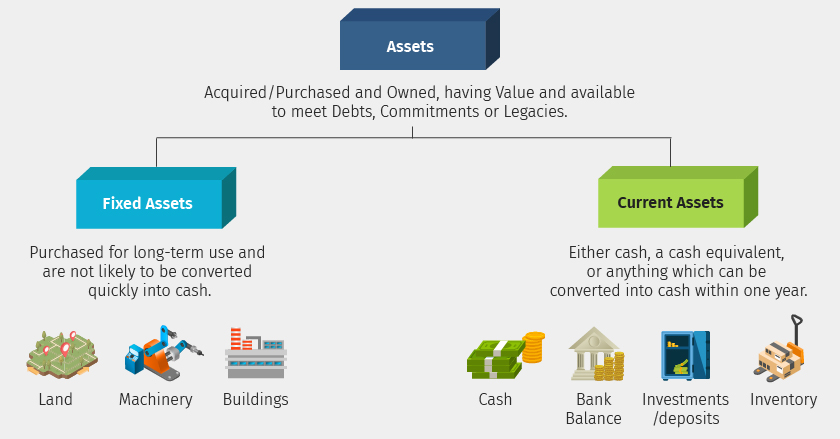

This course covers the detailed discussion, appreciation and application of the Philippine Financial Reporting Standards (PFRS) on the assets, financial and non-financial of a business enterprise. Emphasis is given on the interpretation and application of the accounting standards on Financial Assets and their required disclosures.

The related internal control, ethical issue and management of assets are also covered. Exposure to computerized system in receivables, inventory and lapsing schedules is a requirement in this course.

- Faculty: Bangcaya, Sandra Angela

- Faculty: Villaruz, Shereen Mae

- Faculty: Bangcaya, Sandra Angela

- Faculty: POLLESCAS , RICA CAMILLE

- Faculty: Quiambao, Charisse Angela

- Faculty: Villanueva, Ella Mae

- Faculty: Bangcaya, Sandra Angela

- Faculty: Juanitez, Reinzon James